大摩:现在预测为熊市,这里是选股白名单和黑名单!

本文节选自“国际投行研究报告”微信公众号,作者凌通社。原标题为《摩根士丹利:我们最近削减了香港/中国股票指数的目标,现在预测为熊市,预测人民币走弱到6.65元/美元,只买防御性股票!》,文中观点不代表深蓝财经观点。

【摘要】We identify defensive HK/China stocks,and stocks to avoid in

a bear market post our HK/China index target price reductions and MS FX team's USD stronger-for-longer view.

在我们的香港/中国指数目标价格下降后的熊市和MS FX团队的美元走强观点之后,我们确定防御性的香港/中国股票,以及避免的股票。

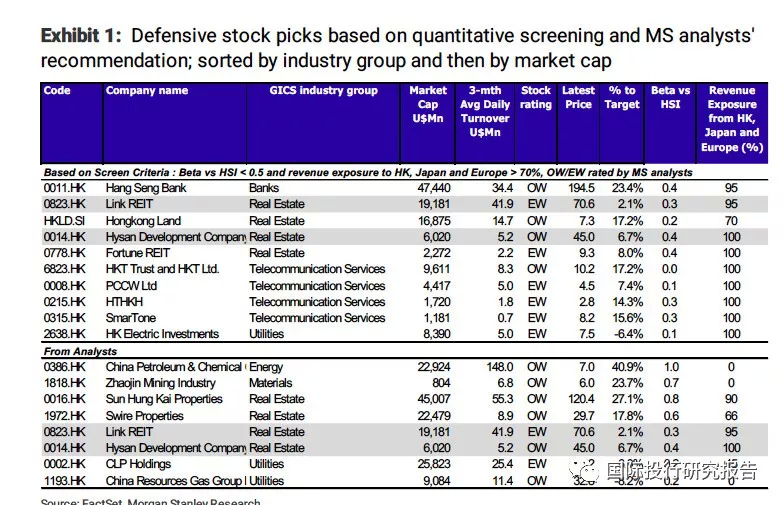

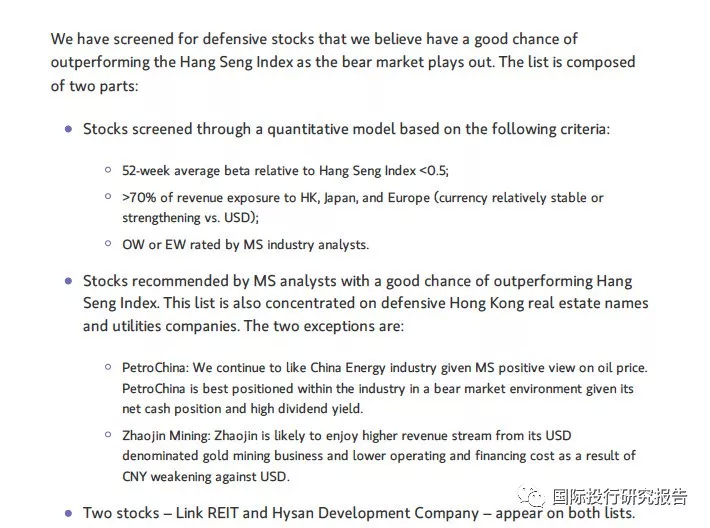

We recently cut our HK/China equity index targets and are now forecasting a bear market.Our house FX view is that CNY weakens further near term to Rmb6.65/USD by 3Q18.We believe it is important to identify:1)stock names that are defensive and likely to outperform the Hang Seng index as the market faces further downside risks(Exhibit 1);and 2)HK/China stocks that investors should avoid in a USD strengthening and/or US-China trade negotiation uncertainty scenario(Exhibit 2).We have also surveyed Morgan Stanley's HK/China research team on how individual sectors are likely to perform as bear market plays out.

The Defensive list is concentrated on defensive sectors with HKD revenue such as Telecom and Utilities as well as defensive HK property players(landlords an REITs).

The To Avoid list is concentrated on stocks with debt and/or other costs denominated in USD,limited revenue exposure in HKD or other currencies that are relatively stable vs.USD,and/or that are susceptible to further US China trade negotiation uncertainty.

我们最近削减了香港/中国股票指数的目标,现在预测为熊市。我们的外汇观点是人民币近期进一步走弱截至3Q18,人民币6.65元/美元。我们认为重要的是要确定:1)防御性股票可能会跑赢恒生指数进一步的下行风险(图1);2)投资者应该持有的香港/中国股票避免美元走强和/或美中贸易谈判的不确定性情景(图表2)。我们还调查了摩根士丹利的香港/中国研究关于各个行业如何在熊市中发挥作用的团队。

防御性名单集中在具有港元收入的防守领域作为电信和公用事业公司以及防御性的香港房地产公司(房东和房地产)房地产投资信托基金)。

“避免”清单集中在有债务和/或其他成本的股票上以美元计价,以港币或其他货币计算的有限收入与美元相比相对稳定,和/或对美国中国的影响较大贸易谈判不确定性

We have also screened for stocks that investors should try to avoid in a bear market.

These stocks often meet one or more of the following criteria:1)higher volatility in terms of beta relative to the market(Hang Seng index);2)sizeable revenue exposure to CNY(weakening against USD)or cost exposure to USD;3)subject to US China trade dispute,which has a lot of near-term uncertainty,etc.

我们还筛选了投资者应该避免在熊市中避免的股票。

这些股票通常符合以下一个或多个标准:1)更高的波动性;2)相当可观的收入风险人民币(兑美元走弱)或美元成本风险;3)受美国中国贸易影响

争议,有很多近期的不确定性等。

In recent years,Hang Seng has become far more dependent on RMB earnings streams with around 60%of earnings derived from China currently.However,it is a HKD-and therefore USD-pegged index.Periods of RMB weakness vs.USD(as in 2015 and early 2016)are therefore associated with bear markets in Hang Seng,whilst periods of RMB

strength vs.USD(from mid-2016 until recently)are associated with bull markets(see Exhibit 10).CNY has begun to move markedly lower against the USD in recent trading,tracking generalised weakness in China's trade partner currencies(EM and Euro in particular).Potential further downside risks to the CNY include a more hawkish Fed,somewhat more accommodative PBOC(which did not raise rates after the last Fed move)and trade tensions between the US and China.

近年来,恒生已越来越依赖人民币,目前中国约有60%的收入来自中国。但是,它是HKD-和因此美元挂钩指数。人民币兑美元汇率走弱的时期(2015年及早期)因此,2016)与恒生的熊市有关,而人民币期间则相关

实力与美元(从2016年中期到最近)与牛市相关(见图表10)。近期交易中,人民币兑美元汇率开始明显走低,追踪中国贸易伙伴货币的普遍疲软(新兴市场和欧元区)特定)。人民币潜在的进一步下行风险包括更加强硬的美联储,更加宽松的中国人民银行(在上一次美联储之后没有加息)移动)和中美之间的贸易紧张局势。

免责声明:深蓝财经网转载此文目的在于传递更多信息,不代表本网的观点和立场。文章内容仅供参考,不构成投资建议。投资者据此操作,风险自担。

相关新闻